sales tax calculator el paso tx

Sales tax in El Paso Texas is currently 825. Use 20 Sales 35.

Perla Diaz Owner Tax Professional Blue Pearl Bookkeeping Tax Services Linkedin

All PPRTA is due if the address is located in El Paso County cities of Colorado.

. For comparison the median home value in El Paso County is. Name A - Z Sponsored Links. 2022 Cost of Living Calculator for Taxes.

The December 2020 total local sales tax rate was also 8250. The Texas sales tax. You can also use Sales Tax calculator at the front pagewhere you can fill in percentages by yourself.

The sales tax jurisdiction name is El Paso Ctd. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 816 in El Paso County Texas. The current total local sales tax rate in El Paso County TX is 6750.

Monument Live in Buy in. El Paso Texas and North Little Rock Arkansas. The 825 sales tax rate in El Paso consists of 625 Texas state sales tax 05 El Paso County sales tax 1 El Paso tax and 05 Special tax.

The sales tax rate for El Paso was updated for the 2020 tax year this is the current sales tax rate we are using in the El Paso Texas Sales Tax. What is the sales tax rate in El Paso Texas. The December 2020 total local sales tax rate was also 6750.

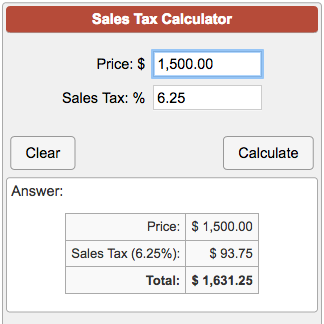

Before-tax price sale tax rate and final or after-tax price. Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list. S Texas State Sales Tax Rate 625 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate You can calculate Sales Tax manually using the formula or use the El.

The minimum combined 2022 sales tax rate for El Paso Texas is. 21650 for a 20000 purchase. How to use El Paso Sales Tax Calculator.

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. El Paso TX Sales Tax Rate The current total local sales tax rate in El Paso TX is 8250. Check your city tax rate from.

All numbers are rounded in the normal fashion. Arkansas are 125 more expensive than El Paso Texas. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in Texas. El Paso The base sales tax in Texas is 625. The El Paso Texas sales tax is 625 the same as the Texas state sales tax.

The El Paso County Texas sales tax is 725 consisting of 625 Texas state sales tax and 100 El Paso County local sales taxesThe local sales tax consists of a 050 county sales. This is the total of state county and city sales tax rates. Choose city or other locality from El Paso.

Cost of Living Indexes. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Sales Tax Calculator in El Paso TX.

While many other states allow counties and other localities to collect a local option sales tax Texas does not.

El Paso Approves Lowering City S Tax Rate By 4 49 Cents Kvia

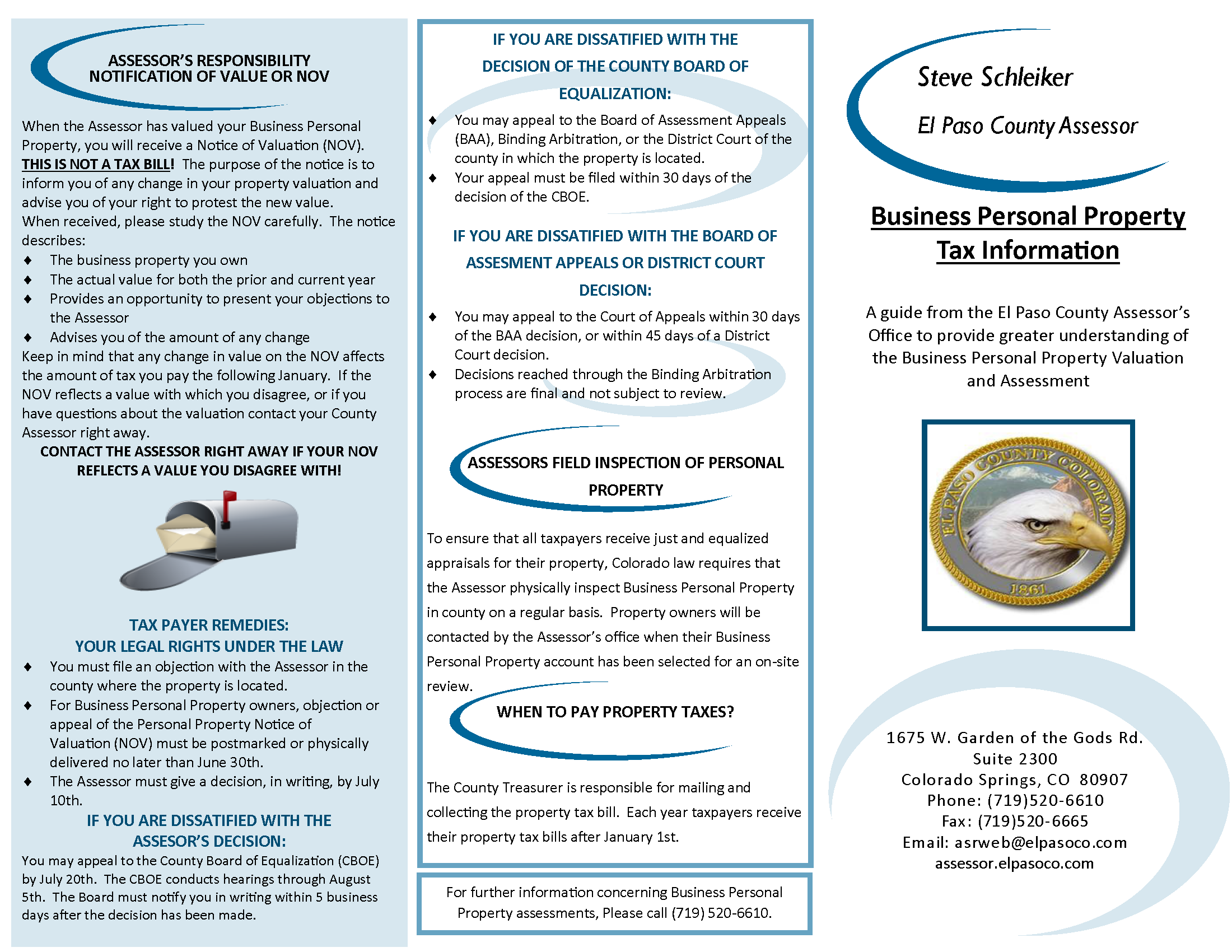

Personal Property El Paso County Assessor

Us Sales Tax For Online Sellers The Essential Guide Webretailer Com

El Paso Property Tax Deadline Is End Of January Kfox

Colorado Sales Tax Calculator And Local Rates 2021 Wise

U S Cities With The Highest Property Taxes

What Income Taxes Do Seattle Residents Pay Quora

Arkansas Sales Tax Rates By City County 2022

Is Shipping Taxable In Texas Taxjar

County Of El Paso Texas Tax Office

Texas Retirement Tax Friendliness Smartasset

Sales Tax Information Colorado Springs

Colorado State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Colorado Sales Tax Calculator And Local Rates 2021 Wise

Texas Sales Tax In 2017 What You Need To Know The Motley Fool