capital gains tax rate california

Just like income tax youll pay a tiered tax rate on your capital gains. Capital Gains Tax Rate in California 2022.

What Is The Effect Of A Lower Tax Rate For Capital Gains Tax Policy Center

Corporate Tax Tools and Services to Help Businesses Accelerate Tax Transformation.

. Contact a Fidelity Advisor. Understand the difference between short-term. 1 week ago Mar 21 2022 Instead the criteria that dictates how much tax you pay has changed over the years.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. 1 day ago The long-term capital gains tax rates for the 2021 and 2022 tax years are 0 15 or 20 of the profit depending on the income of. Additional State Capital Gains Tax Information for California.

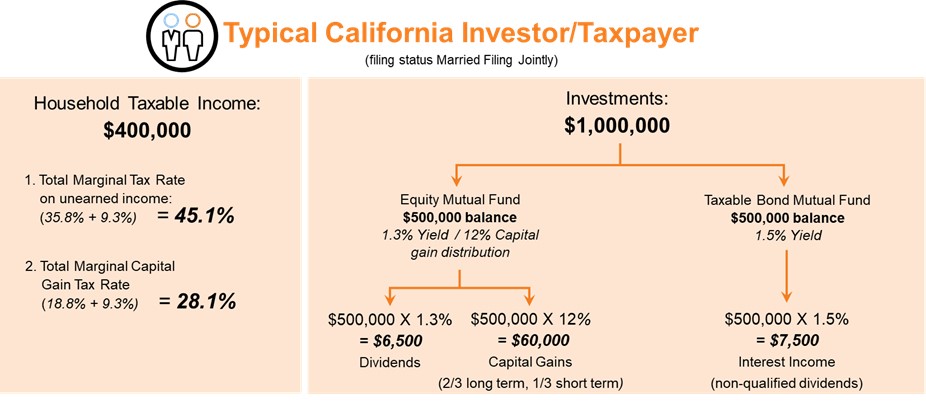

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Unlike federal capital gains rules Californias capital gains tax rate for 2022 is independent of the duration of the gain. Capital Gains Tax Rate in California 2022.

Browse Get Results Instantly. Learn What EY Can Do For You. For example in both.

California does not have a lower rate for capital gains. 2022 capital gains tax rates. As for the other states capital gains tax rates are as follows.

The cost basis is the. All capital gains are taxed as ordinary income. Capital gains tax bracket - tewrbintertestshop.

No state capital gains tax. This California capital gains tax rate applies to. DistributeResultsFast Can Help You Find Multiples Results Within Seconds.

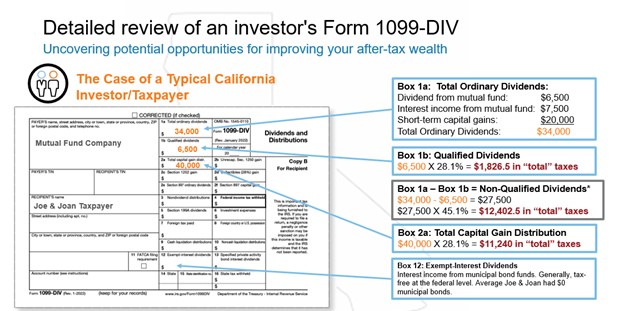

Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Federal Capital Gains and Losses Schedule D IRS Form 1040 or 1040-SR California Capital Gain or Loss Schedule D 540 If there are differences between federal and state taxable amounts. Contact a Fidelity Advisor.

California capital gains tax can be calculated by subtracting the cost basis from the assets sale price. All taxpayers must report gains and losses from the sale or exchange of capital assets. Capital Gains Tax Rates in Other States.

The IRS will charge you a capital gains tax on your California home sale and so too will the state of California through its Franchise Tax Board FTB. This includes stocks bonds mutual funds real estate and personal property. The capital gains tax rate reaches 765.

Capital Gains Tax Rate in California 2022. 1 week ago Mar 21 2022 Instead the criteria that dictates how much tax you pay has changed over the years. The FTB sticks to IRS rules.

For example in both. Know what assets are subject to Capital Gains Tax. 2022 federal capital gains tax rates.

Instead the criteria that dictates how much tax you pay has changed over the years. 2021 capital gains tax calculator. Stocks bonds mutual funds and real.

Unlike federal capital gains taxes Californias capital gains tax rate for 2022 is not based on whether the gain is short-term or long-term. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. Ad Search For Info About California capital gains tax.

Taxes capital gains as. For example in both. The three long-term capital gains tax rates of 2019 havent changed in 2020 and remain taxed at a rate of 0 15 and 20.

3 days ago Mar 21 2022 Instead the criteria that dictates how much tax you pay has changed over the years. Ad Scalable Tax Services and Solutions from EY. Track Clients Potential Tax Liability with Tax Evaluator.

The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. For example a single person with a total short-term capital gain of. Calculating the California Capital Gains Tax Rate 2022.

For example in both 2018 and 2022 long-term capital gains of 100000 had a tax rate. Which rate your capital gains will be taxed depends. Here is a quick comparison of Californias capital gains tax rate to other large US states.

Between 0 and 20.

California State Taxes What You Need To Know Russell Investments

California S Tax System A Primer Chapter 2

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

California State Government Will Lose Big From Capital Gains Tax Increase Econlib

State Taxes On Capital Gains Center On Budget And Policy Priorities

Everything About California Capital Gains Tax

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

Surviving Off A 400k Income Joe Biden Deems Rich For Higher Taxes

California State Taxes What You Need To Know Russell Investments

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

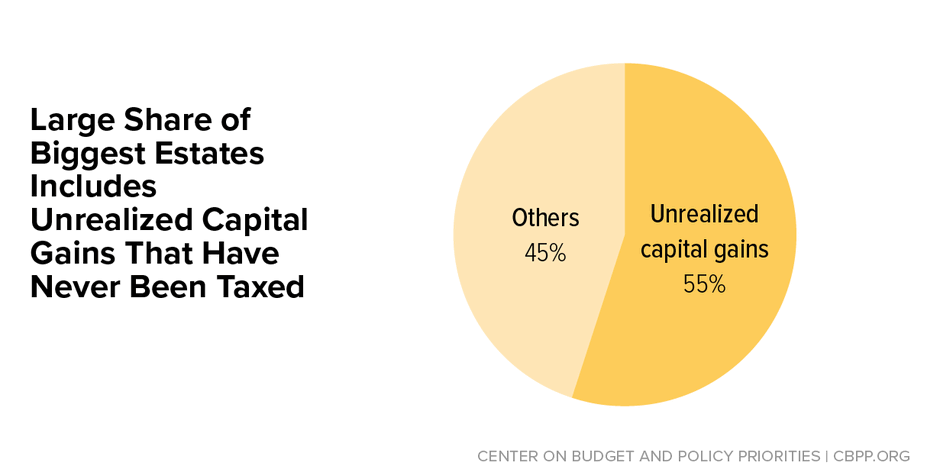

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

How High Are Capital Gains Taxes In Georgia Atlanta Business Chronicle

12 Ways To Beat Capital Gains Tax In The Age Of Trump

An Overview Of Capital Gains Taxes Tax Foundation

2018 Capital Gain Tax Rates For California Residents Pure Financial

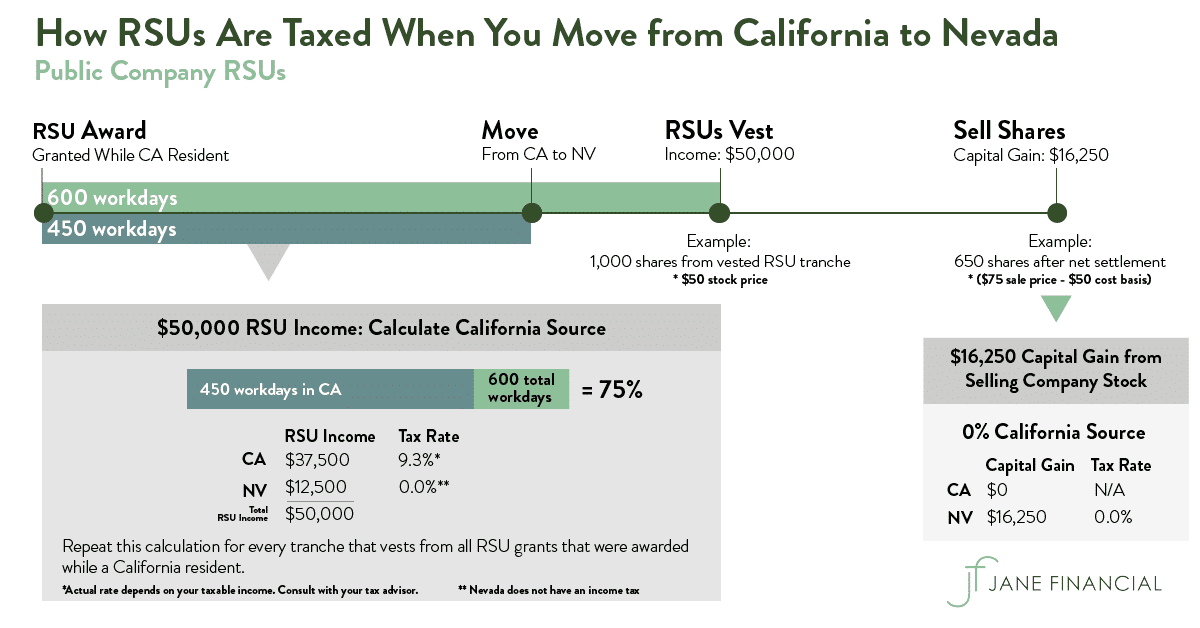

Restricted Stock Units Jane Financial

Taco Tuesdays And Capital Gains Wednesdays Greenbacks Magnet